Whether you’re a private client or a large family business, managing your reputation and reputation risk will be key to your success.

Introduction

Private clients and companies now dedicate more time to managing risks around their reputation than ever before. In a recent survey, Deloitte found that 87% of executives now rate managing reputation risk as more important than any other strategic risk.

This wave of concern has been triggered by an appreciation of its value. Reputation damage severely affects confidence in both a company’s executives and a company’s financial performance.

More than 55% of reputation crises lead to long-term financial loss for a company, according to recent research, with the majority of these losses being classified as “significant” and “large”.

As you start to think about managing your own reputation, in this article, you will find out:

- How reputation works

- How to quantify reputation risk

- Why reputation risk is increasingly important for both individuals and companies

- Putting in place internal controls

- How to manage your personal and corporate reputation risk

- How to respond to emergent reputation risks quickly

- How to control reputational crises

- How to ensure you have an effective crisis response

How to understand reputation risk

The first step in any effective risk plan is building a comprehensive understanding of reputation: how are positive reputations shaped, how do you quantify reputation risk, and who does it affect? We’ll start there.

Who is exposed to reputation risk?

Individuals, families, companies, charities and all other organisations are exposed to reputational risk. Sadly, many people still think reputational risks only lies with corporations, which is not true.

In fact, shareholders, founders, CEOs and executives are more exposed to reputational risk than their organisations. It takes individuals five times as long to recover from a reputational crisis, according to academic research, damaging many executives' long-term careers and business relationships.

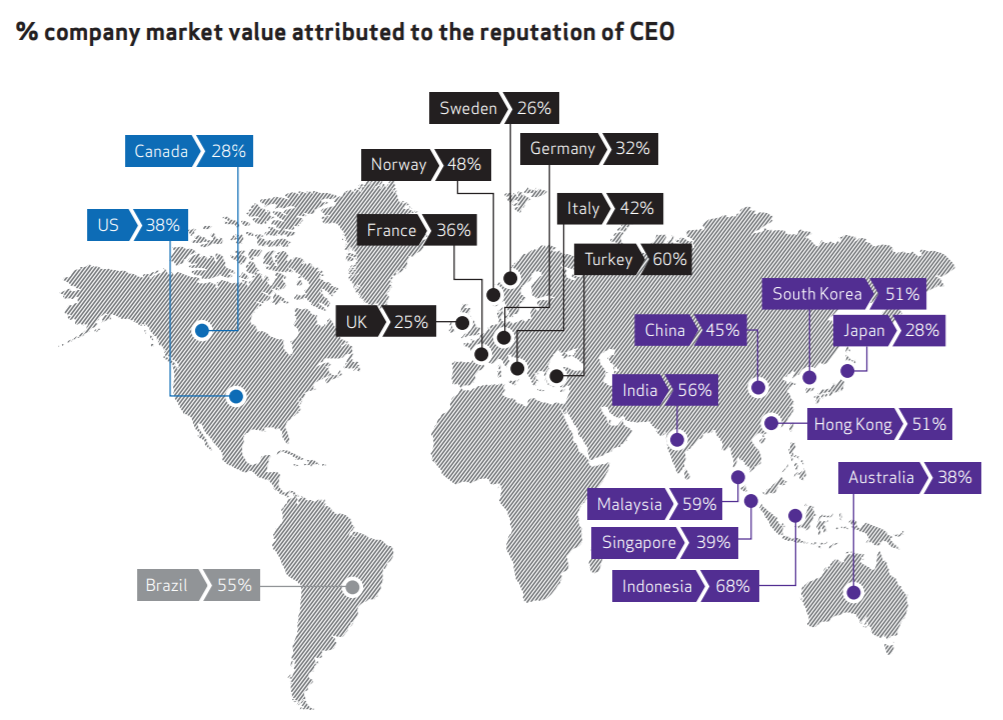

On top of that, it is the reputation of the company owner that drives the reputation of the company, not the other way around, according to research from corporate communications agency Weber Shandwick. The tone at the top matters.

% company market value attributed to the reputation of CEO (source: Weber Shandwick)

What is the definition of reputation risk?

Most people know a reputation risk when they see it, but it is actually surprisingly difficult to define.

You usually know a reputation risk by its impact. Most communications professionals will, therefore, say a reputation risk is any information, coverage, data, video, or other content with the potential to:

- show an individual or company in a negative light…

- ...with an important audience…

- ...leading to immediate or long-term financial, brand or personal loss.

What shows an organisation or individual in a bad light?

There are, of course, many ways for content to shine an unfavourable light on the activities of individuals or businesses. But it is helpful to categorise this unfavourable content in the following three categories:

- Direct criticism of business practices. Information that pours scorn on a company’s corporate activities, such as their sustainability credentials, HR policies, or financial track record.

- Direct criticism of personal decisions. Content that questions the personal decisions of individual people and executives, such as their personal tax residency, their personal pay, or individual behaviour in the workplace or otherwise.

- Content that engenders the wrong impression. Material that may inadvertently or otherwise create unhelpful perceptions in an audience’s mind, even if it’s not directly critical of an individual or company. Flaunting wealth on social media, for example, often creates negative perceptions that impact long-term reputation.

Who is your target audience?

Relevant reputation risks will change depending on target audience of an individual or company.

For example, while the public may perceive relocating offshore for tax purposes poorly, this may not be the case with financial partners. Managing reputational risk must always be done with a specific audience in mind.

Audiences will be unique to a private client or business’s individual circumstances, but there are a number of key common audiences that all individuals and companies should consider:

- the public

- customers

- local community

- regulators

- policymakers

- investors

- financial institutions

- business partners

- suppliers

- professional advisers

- media

Is the target audience always external?

One important, yet overlooked, audience is employees. Many reputation crises start not from customer boycotts or regulatory change but from employees taking a public, critical stand against the company or family they work for.

Many employees see their own reputation through the lens of the individuals they work with or the company they work for, so they are more likely to take a public, visible stand against bad practices they witness.

For example, employees at Google recently wrote an open letter to highlight concerns about the company’s approach to business in China.

This high-profile intervention had a significant impact on Google’s reputation, generating a wave of negative press coverage, and likely damaging the company’s reputation more than an attack from an outside critic.

Where does reputation damage usually take place?

Damaging information does not emerge out of thin air.

Instead, it makes its way to your target audience through established communications channels. Of course, the most obvious way is through the publication of negative news coverage in the traditional media, whether that’s a national newspaper, industry publication, or TV news channel.

Nonetheless, the popularity of social media means more reputational damage is now being done on Twitter, Facebook, LinkedIn and other social networks. There are many examples of social media content going viral and reaching audiences of multiple millions overnight, more than would have read the information if it was published in a traditional news media outlet.

Does this always have to happen on public channels?

Reputation damage does not need to take place on public communications channels. Negative stories can spread on ‘dark’ channels too, such as email, SMS, WhatsApp, or through face-to-face communication, especially among employees and business partners. Sadly, this source of reputation risk is much more difficult to monitor.

What are the most common forms of reputation risk?

Trends in the media, politics and specific industries fluctuate in and out of public consciousness.

But while the key common forms of reputation risk will vary over time, some of the most significant trends in 2020 have been:

- Workplace behaviour. In light of the global #MeToo movement, there has been widespread, highly publicised backlashes against poor workplace conduct.

- Sustainability. In response to increasing global concern about climate change, there has been significantly more focus on the environmental credentials of individuals and companies.

- Diversity. Following the high-profile Black Lives Matter campaign, there has been a push for business owners and companies to introduce progressive recruitment policies for people from diverse backgrounds.

- Gender pay gap. Following the introduction of gender pay-gap reporting in the UK and elsewhere, there has been an increased focus on the pay differential between male and female colleagues across businesses.

- Supply chains. In response to consumer activism, there has been increased scrutiny on the treatment of supply chain partners.

- Data breach and privacy. A lot more attention has been put on how companies are using customer data following the introduction of GDPR in Europe, a number of corporate data-loss scandals, and high-profile coverage of how companies like Cambridge Analytica have used social media data to micro-target messages.

- Fraud and accounting standards. On the back of a number of high-profile accounting scandals, such as Patisserie Valerie in the UK and Wirecard in Germany, there has been increased scrutiny on the integrity and accuracy of company reporting.

- Tax contributions. In light of taxpayer-funded support schemes for businesses impacted by a coronavirus, there is now significantly more press attention on where business owners base themselves for tax purposes and whether they accept taxpayer-funded government support.

How do you quantify reputation risk?

Quantifying exposure to reputation risk is often a complicated combination of factors, both known and unknown, which makes it difficult to accurately calculate.

It is, however, possible to get a good snapshot of an individual or company’s reputation risk by estimating the following factors:

- Probability of a negative event happening. How likely are you or your company to be implicated in a negative reputational event?

- Financial and brand damage this event would have. If this negative event did come to pass, what would be the financial implication on the individuals or business involved?

How do you quantify the risk of a potential negative event happening?

Many PR professionals will use a scorecard or risk assessment to estimate reputation risks, itemising the individual risks that a company or individual faces to determine its risk level.

As this process is often inaccurate and slow, Transmission Private has developed its own proprietary data-driven methodology for evaluating risk on an ongoing basis:

- Track similar individuals or companies. We track qualitatively similar individuals and companies to calculate how regularly they are involved in events that impact their reputations

- Quantify impact. We quantify and qualify the impact of these events on the basis of their structure, sentiment and severity

- Determine risk. We adjust a client’s risk by their visibility within that class of individuals or companies, as well as their exposure to those same risks

Why is reputation risk important?

Putting in place an effective reputation risk management strategy is key to both:

- avoid reputation damage and harm, and

- realise the benefits of positive reputations

The negatives of a poor reputation

Evidence shows that a poor reputation leads to worse financial performance, increases the difficulty of doing business, and creates a cycle of increasingly negative, harmful public, press and regulatory attention.

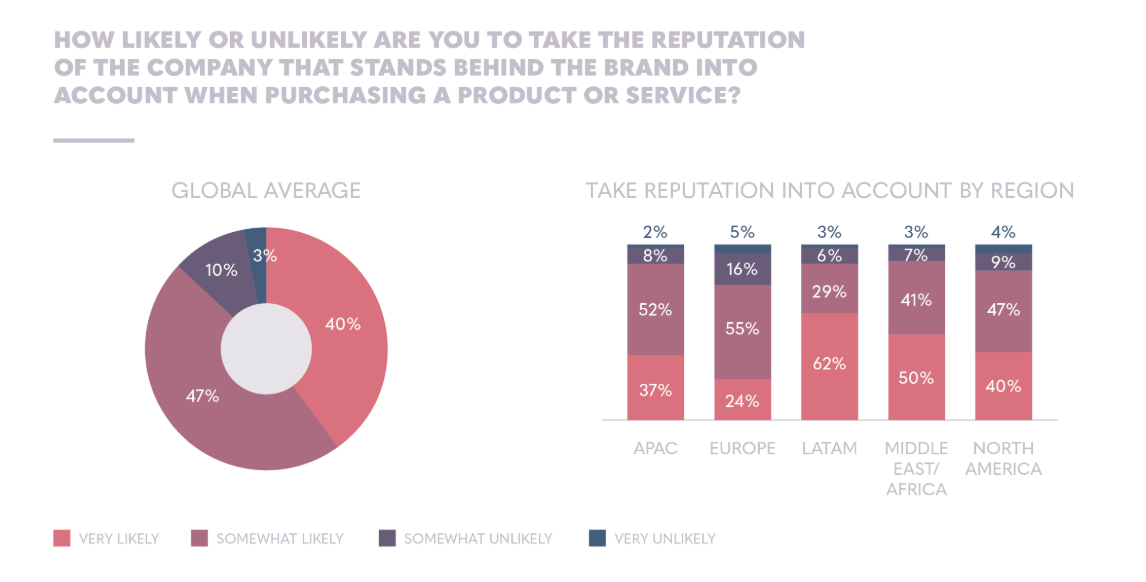

On one hand, customers are increasingly concerned about reputation. In Europe, 80% of consumers say they are “likely” or “very likely” to take into account company and brand reputations before making a purchasing decision, according to polling agency Ipsos MORI. This number rises to 85% in North America, and 90% in Asia, Latin America and Africa.

Impact of corporate reputation on buying decisions (source: Ipsos MORI)

This has sent waves of concern through business supply chains, with public-facing companies choosing to distance themselves from individuals and companies who may open them up to criticism. In the context of private clients, many banks are now taking a particularly aggressive approach to their client book, turning down customers who may expose them to even tangential reputation risk.

On the other hand, there are an increasing number of communications channels that expose individuals and companies to potential criticism, increasing the stakes for individuals and companies. The Internet and social media have turned everyone into a publisher:

- 500 million tweets are posted on Twitter every day

- 600 million blogs are active at any moment in time

- 500 hours of video are uploaded to YouTube every minute

It is infeasible to believe this content will not mention you, your company or brand.

At the same time, the immediacy of social media means that negative stories, whether misinformation or otherwise, travel much faster than ever before. According to research from the University of Warwick, it takes an average of 14 hours for a false claim to be corrected on social media, and by this time the damage is usually already done.

The positives of a good reputation

While many individuals and companies recognise the drawbacks of a poor reputation, they overlook the numerous benefits of positive reputations. There are, in fact, many, including:

- Financial performance. Corporate reputation accounts for more than 25% of a company’s stock market valuation, according to academic research.

- Attractiveness to investors and business partners. More than 87% of CEOs, entrepreneurs and other individuals say that a strong personal reputation attracts investors and new business partners, according to Weber Shandwick.

- Recruitment and retention. More than 8 in 10 executives say that a strong personal reputation helps them attract talent, and another 7 in 10 say it helps them retain talent.

- Company resilience. Companies with stronger reputations recover more quickly from crises than those with lower levels of trust, according to Ipsos MORI.

How do you manage your reputation risk?

Now you know how to understand, evaluate and assess your reputational risk, how do you manage it? What management planning do you need to undertake?

1. Clearly define your audience

An individual or company’s reputation risks will differ from audience to audience. Different audiences care about different factors. Get clear in your head where you want to manage your reputation risk first. Ask yourself the following question:

- If a crisis were to hit tomorrow, which audience would be the most important for continuity of your personal activity and business?

That is the first audience you should focus on to manage reputation risk.

When individuals and companies ask themselves that question, they tend to answer by saying their suppliers, customers and funders. But do not overlook your employees. If your team loses confidence in your reputation as an individual or business, it can lead to devastating walkouts.

2. Build a picture of where they currently acquire information

Taking each of these audiences in turn, take the time to understand:

- where they read about you most often, and

- how they go about acquiring information about you or your company.

This may be on both public and non-public channels. For example:

- Suppliers will most likely acquire information from the industry trade press

- Employees may read through internal company newsletters

- Members of the local community may read regional newspapers

- Senior industry contacts may acquire information through face-to-face engagement

- Financial institutions and other partners may read your quarterly financial statements and annual reports

- Members of the public may read the mass media and social media, or even acquire information through their customer service experience

There will often be no single answer for any audience, but this exercise will give you a clear sense of how information is acquired about you or your company. It enables you to identify the communications channels where a reputation crisis is most likely to develop, spread and evolve.

3. Understand current perceptions

Any effective reputation risk strategy must start with understanding current perceptions. In light of the previous steps, you should have a sense of where your most important audiences acquire new information about you.

Now undertake a research exercise to evaluate all the material on these channels about you as an individual or company. For example, you may want to read, evaluate and categorise the last decade of content about you or your business to understand the sentiment of this material and uncover any recurrent trends and themes. In many ways, this is the first step of a risk assessment exercise.

You may also want to use big data tools to evaluate raw information at scale. Transmission Private uses its own proprietary tool to conduct this analysis for clients at scale. But there are other standalone tools on the market, including Sprout, Brand24 and Awario, that enable you to digest large amounts of historic data on social media, and elsewhere, for your own sentiment analysis.

4. Understand current risks

The research exercise will give you a sense of whether you are perceived negatively or positively on different communications channels. Now look at the negative and positive mentions, and pick out the key themes in the data:

- What issues repetitively led to positive coverage and comments in the past?

- What issues repetitively led to negative coverage and comments in the past?

Reputation events tend to reoccur in cycles, with individuals and companies being criticised for the same decisions, missteps, and choices time and again.

This will provide key data for you to develop a risk assessment strategy to mitigate similar reputation crises in the future or, if desired, recover your personal or corporate reputation on these topics. This will require a communications plan.

5. Track mentions to you, associates, partners and other entities

You will now have a baseline understanding of how your reputation sits as well as the risks that you have been exposed to in the past. But risks evolve on a daily basis – and the most dangerous are those that are new and unexpected.

Next, implement robust online monitoring to track mentions that may expose you to reputational risk. This should go beyond mere monitoring of mentions of you or your company, and should include monitoring of key business partners, associates and other related entities. You need 360-degree intelligence on what is happening across all communications channels.

While extra weight should be put on monitoring the channels where your key audiences acquire information, a robust solution monitors all channels in as close to real-time as possible:

- print media

- social media

- online news media

- public filings, including company registers

- parliamentary records

- data leaks

- stock image sites

- video websites

- comment sections

There are a number of solutions that enable you to monitor these channels on an individual basis. For example, Hootsuite, Mention and TweetDeck enable companies to monitor references on Twitter.

If you want a comprehensive, fail-safe solution, Transmission Private provides its own fully-managed reputation monitoring service that tracks all of these channels, and is tailored to private clients, family offices and family businesses.

6. Track references to your competitors

Key reputational risks tend to affect whole industries. They do not simply attach themselves to single individuals or companies. If you restrict your monitoring to your own company, you will miss the most significant reputation risks.

It is very unlikely that you will be the first individual or company to be subject to public scrutiny on a specific topic or trend. For example:

- If you run a luxury fashion business, you may be hit by negative reporting about the carbon footprint of your supply chain. If you were monitoring competitors, you will have seen this was a common reputation risk.

- If you are a political donor, you may be hit by accusations of cash for access. Again, if you were monitoring other donors, you will have seen this was a common risk.

- If you’re the founder of a construction firm, you may be subject to questions about safety on your sites. Yet again, if you were monitoring similar companies to yours, you will have seen this was a common line of questioning.

Putting in place robust monitoring of either individuals or companies who are in the same industry as yourself – or are exposed to the same types of risks – will provide important future intelligence on the emergent risks in your sector.

7. Spot emergent trends before they become risks

It is not enough to simply monitor and track similar individuals and companies passively. This monitoring will return a substantial amount of raw data in the form of news stories, social media posts, and other content.

This data needs to be analysed either:

- Manually through human-led intelligence to identify spikes in negative and positive content, or

- Automatically by software to tease out the key themes and topics

If a trend has impacted a competitor’s reputation or brand, it is likely only a matter of time before it impacts yours as well.

While many themes will reoccur from month to month in the data, the most dangerous are those that peak rapidly. You should track the amount of coverage about different themes in your industry to evaluate whether there is new-found interest in a particular area that needs specific attention.

8. Request information from internal departments to assess risk exposure?

Emergent risks need to be assessed in the context of how well you or your company are doing on this particular theme or trend. It is only possible to assess this properly with full, transparent, up-to-date information internally.

It should be within the power of the person responsible for managing reputation risk in the family office or company to request detailed information from across an organisation to evaluate the risk that a new trend may present to a family office, charity or company.

Often there is resistance in any organisation to the candid sharing of information which could make either the business, its departments or its executives look bad. This resistance needs to be eliminated so that risks can be properly assessed and evaluated.

9. Change behaviour in response to emergent trends

If the company is exposed to a new reputation risk, its executives should decide how to respond. The most immediate way is to change behaviour, such as putting in place more robust internal controls, undertaking product recall, relocating for tax, or otherwise.

In assessing whether this is the most appropriate response, it may be worthwhile comparing:

- the financial impact of this change in behaviour to the individual or business, against

- the risk-adjusted financial cost of the reputation risk being realised

It is worth adding that it is not possible to simply manage or control reputation risks through crisis management and communications strategies. The only way to truly eliminate risk is to take concrete action to change behaviour.

10. Preparing for a reputational risk

In many cases, it may not be possible, easy or financially feasible to change behaviour in response to an emergent reputation risk.

In these cases, it is best to collectively recognise the risk and prepare through developing a comprehensive communications plan:

- Draft a fact sheet with clear factual information about the issue to brief and update stakeholders

- Write a statement for internal use to communicate clearly with employees about the issue

- Draw up an external statement for use with the press and media

- Create clear guidelines on who can and cannot speak with different stakeholders

- Develop a comprehensive communication plan to set strategy for managing stakeholder response

Each risk will require a different strategy and approach. If you need assistance, Transmission Private can provide time-critical, expert communications and PR advice to you, your family, family office or family business.

11. Build a platform to respond to reputation risks directly

Ultimately, the best strategy to manage reputation risk is to speak directly to your stakeholders via your own controlled channels as soon as possible after a crisis starts to emerge.

By speaking directly to your stakeholders, you get complete control over how you respond as well as the opportunity to articulate your perspective in your own words.

Private clients and companies should consider how best to build their own controlled communications channels rather than communicating only via national, local and trade publications.

Common controlled communications platforms include:

- corporate websites

- family office websites

- family foundation websites

- quarterly updates to stakeholders

- financial statements and annual reports

- social media channels

For business owners and private clients, we find one of the most powerful and overlooked ways to respond to a reputation risk is via their own website. That will often mean building out a website for the family ahead of time in the form of a holding company website, for example, which provides the family with a direct route to respond to risks, trends and questions.

Good luck and happy monitoring.