This article is an extract from Transmission Private’s monthly newsletter, The Lede, which tracks the world of reputation management for private clients. You can sign up for the newsletter on our website via the tab at the bottom of this article or by completing the form here.

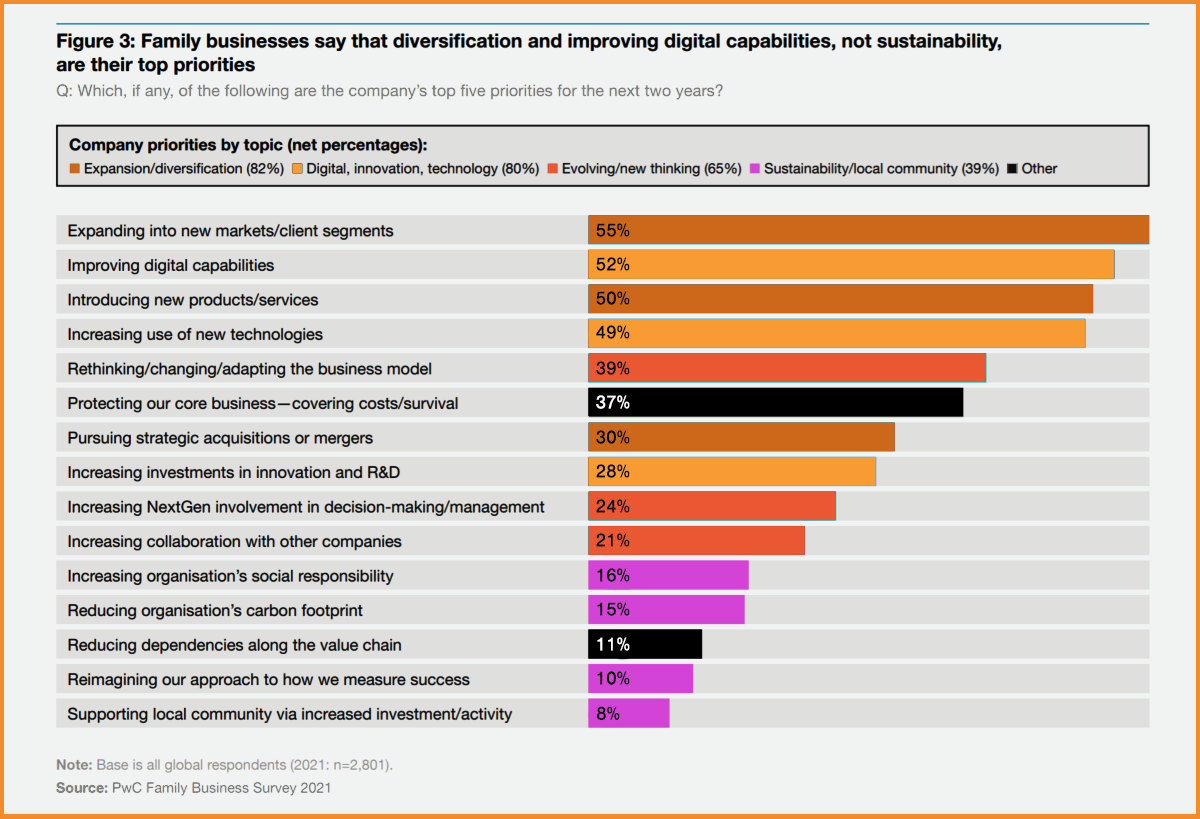

Business diversification and digital transformation are family businesses’ top priorities, according to PwC’s Global Family Business Survey. Meanwhile, shockingly, family businesses put social credentials at the bottom of their priority list. 🌳 The same is likely true of entrepreneur-led private companies.

What do family businesses say about ESG? Only 16% said that reducing their carbon footprint was a priority this year. A mere 15% said the same for increasing social responsibility, and just 8% said local community impact was a priority. On the other hand, a massive 55% said their focus was expanding into new markets.

Why is ESG so far down the list? Understandably, private businesses want to build resilience through diversification. If 75% of your portfolio is in hospitality, the pandemic will have been a painful reminder to spread your risk. The pandemic has also accelerated digital transformation. Family businesses are racing to catch up. These are taking priority. Plus, with finances strained, social responsibility may seem like a luxury.

Why could this backfire? But, curiously, private companies may be shooting themselves in the foot. It is only possible to diversify your business if either: i) you can pull-off strategic acquisitions, giving yourself a foothold in a new industry, or ii) pull together teams to push your business into new sectors. The same is true of digital transformation: acquire or hire. And strong CSR credentials are essential if an entrepreneur wants to pull off acquisitions and top hires.

But why is ESG key to acquiring and hiring? As Transmission Private’s in-house research repeatedly shows, strong ethical credentials are fundamental to getting deals through and turning businesses into talent magnets.

- Pulling off acquisitions. When considering takeover offers, owners are looking to sell to entrepreneurs and private businesses with a robust track record of ethics and integrity. Public social responsibility credentials, then, give private companies a vital edge.

- Accessing competitive investments. When considering potential investors, investees prefer taking money from entrepreneurs with a public track record of strong ethics, whether that’s an evident commitment to impact, visible sustainability programmes, or demonstrable record of local community work. (full research here)

- Winning the war for talent. When considering whether to jump ship to a competitor, potential recruits are more likely to leap if the entrepreneurs and their businesses, again, have a public track record of strong ethics. (research to be published this month)

The takeaway... family businesses are focussed on diversification and digital transformation rather than CSR. But it is social responsibility that is key to unlocking routes to diversification and digital transformation.