This article is an extract from Transmission Private’s monthly newsletter, The Lede, which tracks the world of reputation management for private clients. You can sign up for the newsletter on our website via the tab at the bottom of this article or by completing the form here.

Two-fifths of family offices are building their brands to improve VC deal flow, according to Silicon Valley Bank. Their recent report, Family Offices Investing in Venture Capital, found that 38 percent of family offices are taking concerted steps to attend conferences, launch websites, or undertake similar activity to build their brands.

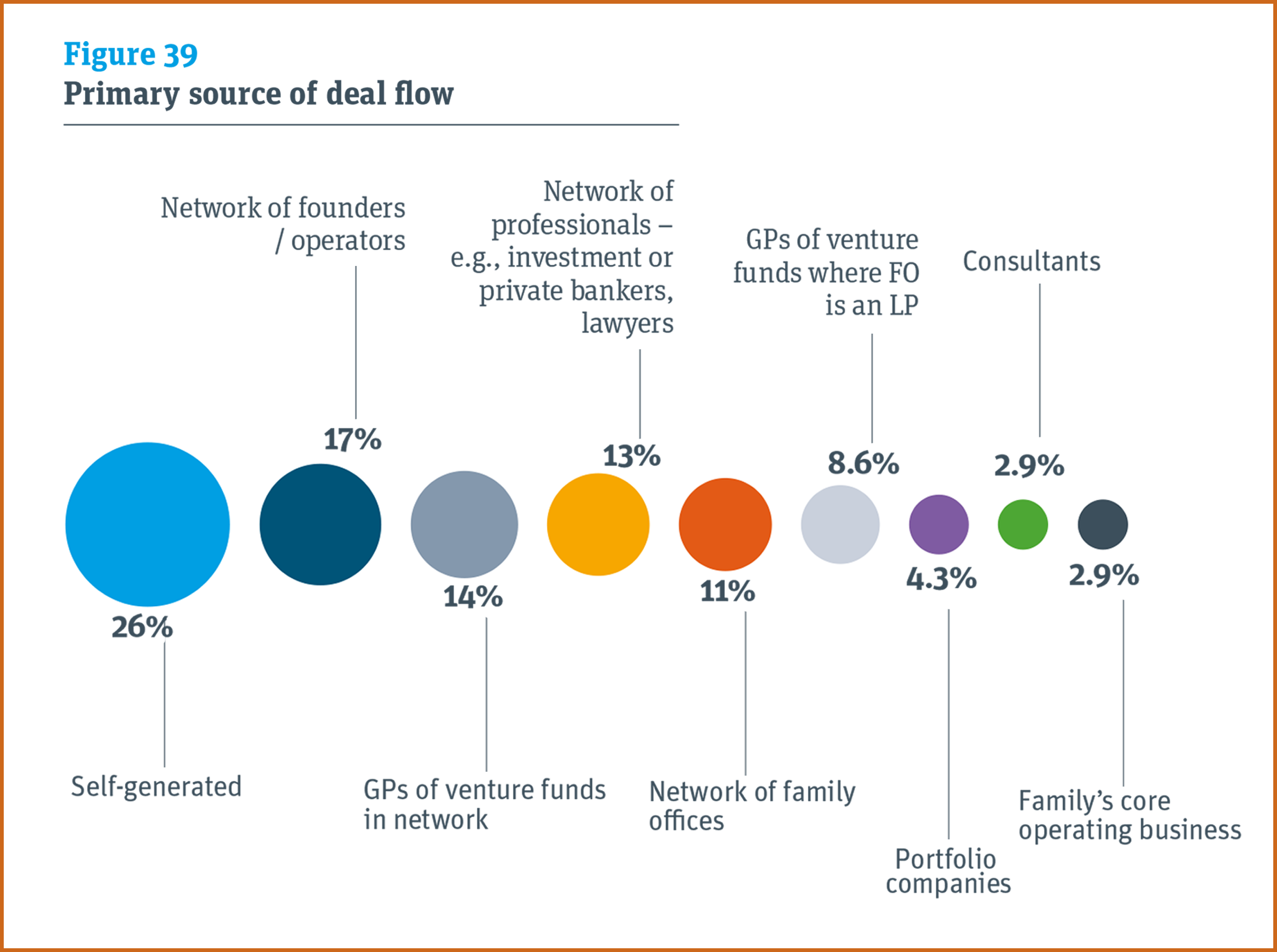

Why are family offices building their brands? Because competition for the best VC deals is a huge growth barrier to family offices. It was family offices’ top challenge, with 28 percent saying that it was their primary obstacle. Interestingly, deal flow, in general, was not a top concern (only 4.5 percent ranked it first) — just competition for the very best deals.

Is it working? It seems so. On one hand, Transmission Private’s own research shows that investee targets choose between different capital sources on the basis of the investor reputation. On the other hand, SVB’s results show that 26 percent of family office deal flow is self-generated. Furthermore, 67 percent of family offices say they do not use to deal flow consultant. Of course, it’s impossible to draw a link between brand-building and this ability to self-generate deal flow, but these statistics are telling.

How are they doing it in practice? There are a number of ways that family offices are building their brand.

- Brand creation. This first obvious step is often missed. Before generating brand awareness, it is important for a family office to have a brand in the first place; an umbrella entity name for all their investment activity. It could be a family’s surname, or something different. Invest in high-quality visual collateral, such as logos. It makes a big difference.

- Family offices network-building. Take steps to participate in family office conferences, speaking events, and, potentially, family office networking groups. These can be hit and miss, so be selective. Using LinkedIn is also an option for networking. Entrepreneurs like Richard Branson, Brent Hoberman, and Terence Mordaunt are active on the website.

- Online visibility. Create a website for the family office, even if it is understated. This is also an opportunity to lay out the mission, values, and portfolio of the family office. These days a family office’s search results are a proxy for its reputation, and the lack of information online is often misread as a warning sign amongst investee companies and partners.

- Public relations. Engage in selective and careful PR and media activity. This does not mean having to secure coverage about the family office itself, but simply ensuring that it is namechecked in funding announcements. This will do a world of good in building credibility amongst future prospects.

Takeaway... more family offices are investing in brand-building activity than ever before. Family offices that do not start now will soon find themselves missing out on deals and playing catch-up.