This article is an extract from Transmission Private’s monthly newsletter, The Lede, which tracks the world of reputation management for private clients. You can sign up for the newsletter on our website via the tab at the bottom of this article or by completing the form here.

Three-quarters of company leaders say that generating long-term value is now critical to business success, according to EY’s latest Corporate Governance Survey. And yet... managing short-term expectations amongst investors, employees, customers, and regulators is a big hurdle to doing just that, according to the same research. 🚧

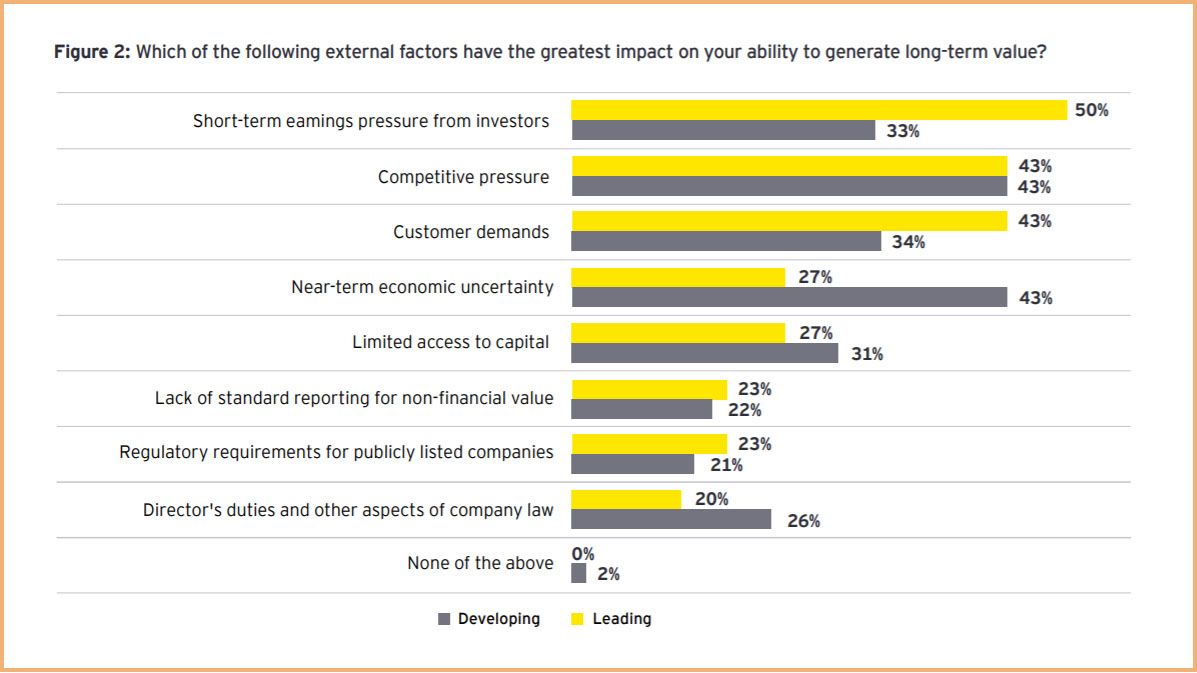

What are the obstacles to generating long-term value? Company leaders are feeling pressure from all quarters. Investors are putting Boards under pressure to bounce back in the post-pandemic economic recovery quickly. Employees only want to work for companies that have a clear purpose and act in a sustainable way. Regulators are ratcheting up standards. Suppliers are cautious about who they work with for fear of finding themselves nursing bad debts. And consumer behaviour is increasingly unpredictable.

So, what can company leaders do? Faced with this multi-dimensional pressure cooker, Boards must find effective strategies to positively engage with multiple stakeholder classes at the same time. In a fast-moving world, finding a way to hit two (or even three) birds with one stone will deliver the best results. 🐦

Is reputation key? Yes. By taking proactive control of their own personal reputations, Board Members and company leaders are able to give themselves an edge with all stakeholders groups... at the same time. In particular:

- Investors. Investors are looking to financially back leaders with strong ethics and business credentials, according to our research. If Board members take proactive steps to selectively enhance their own personal reputations, it will help to placate these investors.

- Employees. Employees desperately want to work for businesses led by Senior Executives and Boards with strong personal reputations, finds that same research.

- Regulators. Regulators know that organisational behaviour is an artefact of its leadership. If Board members take steps to evidence their integrity, do not be surprised if regulators are less hostile, combative, and antagonistic.

- Business partners and suppliers. Everyone worries about being left with bad debts on their hands, especially in this climate. Showcasing personal ethics and integrity at the top of an organisation will give a company an important edge with business partners and suppliers.

The takeaway... all the walls are closing in on Senior Executives and Boards at the same time. And, yet, reputation uniquely has the power to push back these walls simultaneously.