This article is an extract from Transmission Private's monthly newsletter, The Lede, which tracks the world of reputation management for private clients. You can sign up for the newsletter on our website via the tab at the bottom of this article or by completing the form here.

Businessowners do not trust their children to take over the business. 🔗 More than 50 percent of ‘wealth-originators’ do not trust the next generation to look after the family’s business, wealth, and investments, according to new research produced by the Barclays Private Client team.

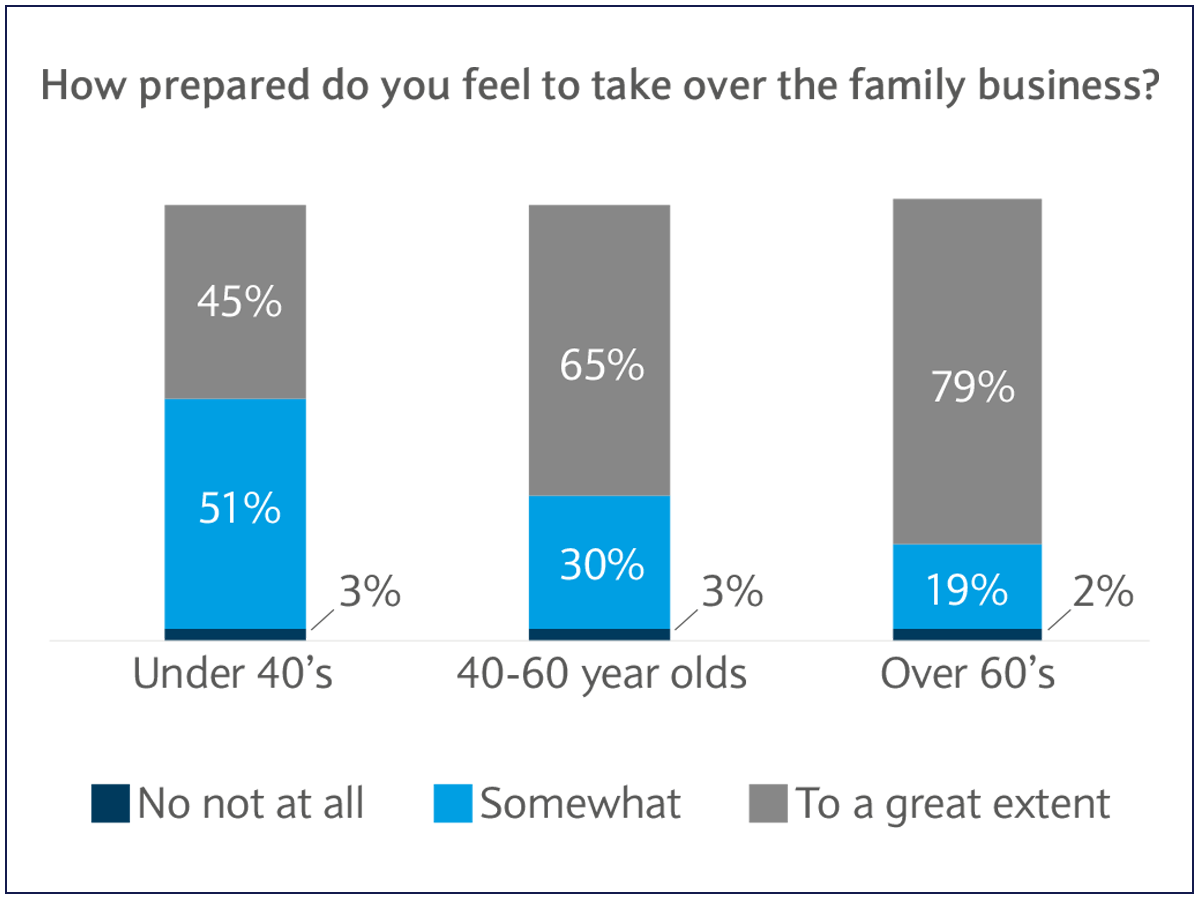

Why would that be the case? Here’s a starter for 10. A staggering 63 percent of entrepreneurs feel the next generation are not as committed to managing the family funds as they are. On the flip side, over half of those under the age of 40 do not feel the family business is discussed with them as much as it should be.

How do you bridge the gap? Interestingly, one of the biggest differences revealed by the research was the two generations’ differing attitudes towards wealth. Members of the next generation want to stay entrepreneurial and grow the family’s pot, while the current generation is now in preservation mode. Thirty percent of youngsters want to increase the family’s wealth—almost three times higher than those over the age of 60.

What can families do? The clock is ticking. Waiting for a resolution to present itself is not a sustainable, long-term strategy.

- Recognise differences. The gulf between young and old has never been wider. By appreciating the differences, families can overcome this intergenerational animosity and focus on moving forward with successful business transfers—as many generations before them have done.

- Communicate expectations. One way to manage these issues is by ensuring everyone clearly understands the roles and aims of each family member. Sometimes such discussions require a certain degree of formality. In such cases, family offices can help by establishing governance or by formalising what is expected from each family member.

- Get professional guidance. Succession is a stressful and exhausting time for families. Professional advisers have tried and tested methods to promote unity and reduce the potential for disputes. Ensuring that everyone agrees on a decision about the future of a family business and the use of family wealth.

The takeaway... communication is key. Families cannot escape the inevitable. Eventually, the next generation will become the current generation. Families must formulate a plan now—and, importantly, not only on the financial and legal side but the communications side too.